Arista Targets SPs With a Single Services Control Plane Based on EVPN

Arista will also do engineering which allows for brownfield insertion

Figure 1. Arista SP advantages. Source: Arista Networks.

The Important

Arista’s view of SP Transformation is centered on segment routing and EVPN, which is aligned with industry thinking. I have written about this previously.

Arista brings many great strengths to everything it does, that are independent of use case: it’s internal software testing infrastructure, expertise in merchant silicon integration, system design, system velocity, significant programmability/automation experience with hyperscalers, and one binary for all platforms (feature dependent on chipset). Arista has always placed considerable focus on quality, and as I have written in the past, I view quality as being a fundamental economic determinant of demand/price level.

I continue to believe that SPs are creating barriers to entry by requiring new vendors to support legacy protocols/architectures, but that is a reality, which makes some use cases enormously complicated to insert into. As I indicated in “Segment Routing and the death of QoS”, I do view access/metro as being a complicated area of the network to insert into, with some telecom specialists being more likely to deliver the laundry list required there. Cisco to some extent as well. Obviously Nokia, Huawei, and Juniper will compete there too.

Peering and Data center interconnect (DCI) are likely to be good opportunities for Arista to start growing their SP business.

It would be helpful to Arista’s cause to get out some more public announcements on peering and DCI wins. At the moment, establishing their brand as a SP supplier is important for unaided awareness.

Discussion

October 22nd, 2020, Analysis of Arista Presentation on SP Transformation.

Figure 2. Video replay of presentation. Source: Arista Networks

In some ways Arista is an Enterprise-oriented company, in other ways it is not. They are interesting to observe in that sense. Arista are an Enterprise-oriented company in terms of some of the leadership, they cut their teeth in the finance vertical, and they have been more focused historically on data center “switching” than SP WAN routing. However, they have not to date been a long-tail Enterprise-oriented company, and have had many successes on the back of intimate, technical sales. That will serve them well with some SPs, notwithstanding they have competitors who sell at very high-levels of SP organizations, pitching end-to-end transformation stories, etc.

On the go-to-market side, the biggest questions around Arista is their adjustment to very long sales cycles, powerful procurement organizations, and whether their high-velocity system output advantages can be leveraged.

All that aside, it comes down to Arista finding fit, leverage, and differentiation, across multiple customer segments/use cases. Peering and Data center interconnect (DCI) are in that category. Arista can position their high-performance, dense, multi-port speed interfaces in those opportunities, focusing on what software capabilities customers need. They may also be able to offer appealing commercial terms.

I have long doubted Arista would delve into the world of 5G Access any time soon (Flex-E/G.mtn, CPRI, e-CPRI, CPRI to O-RAN, TSN,…). OTOH, there is the question of whether 5G access/metro and automation are overburdened with too many standards / complexity. I wrote a little about that here. The net is I expect 5G to be deployed with a large amount of radio specific stuff in access, but vendors who do not support all the mobility specific specifications, can still be opportunistic. Some wholesale plays may fit into that category.

In addition, as Cisco argues, SPs should consider leveraging common aggregation networks for both wireless and wireline. Arista could potentially play there as well. Backhaul, and maybe mid haul as too. Arista did mention they have discussed micro-OLT with suppliers. That particular technology is a better fit for 5G access and Enterprise business services, today, than residential. There is a question of timing on that opportunity: when SPs are ready to go big, and when Enterprises are ready to accept that a multi-point technology like PON will not negatively impact SLAs/response to outages.

Arista did not say it, but their recent presentation implied they are currently focused on SR MPLS, when it comes to segment routing. This is likely customer driven at this time (what the customers they are engaged with want). In addition, SR MPLS is likely to be the more common variant of SR in the next couple of years. SRv6 has and will see some deployment.

Will Arista play in the core with dense 400G offerings? Arista has not given an indication that is one of their main focus areas. I did ask Arista for their take on Drivenets. Many questions have been generated about Drivenets since the AT&T announcement, and Wall St specifically wants to know if there is a major inflection occurring. Arista observed that the Drivenets proprietary interfaces between the controller and the forwarding software/boxes stands in contrast to the open interface approach of Arista, based on standard routing protocols. I’ve lived through proprietary interfaces for a scale out / distributed router / fabric, once in my life, already. You can make the argument that it is just like the proprietary interface between a routing engine and its line cards within a chassis design, however, that does not change the reality that it locks the SP into one vendor for all parts of the solution. So it comes down to SP preference. This is something to keep an eye on when it comes to broad adoption.

Conclusion

Arista is a company with many strengths. Making the argument to customers that they should consider a new supplier when there are already multiple incumbents, is always challenging. The best opportunity to do so, is when there are technology/architecture/business model transitions in the market.

Figure 2. Delivering an elastic core, with supercore nodes, using EVPN as a single control plane for services. Source: Arista Networks.

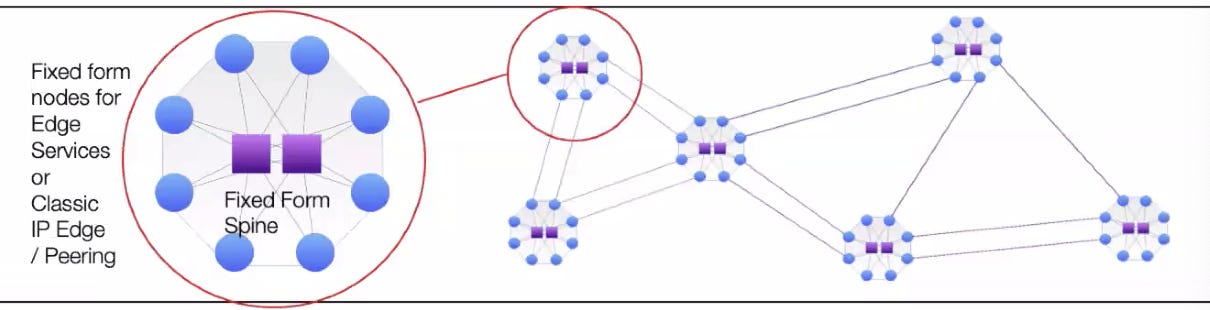

If as Arista suspects, there is a transition to spine-leaf/leaf-spine in SP networks and a single EVPN-based control plane, then Arista has an opportunity to insert on dimensions other than quality, density, automation experience, and range of platforms. I have written about EVPN as a single service control plane previously.

In terms of the move to spine-leaf, there are a couple of issues mudding the waters at the moment. There is the previously mentioned questions about proprietary interfaces in disaggregated models (which SPs are kicking the tires on), and also some industry focus on routing protocol efficiency in dense spine-leaf environments. Arista is addressing the core problem in the latter conversation by supporting Dynamic flooding on Dense Graphs. Arista brings that spine-leaf experience to the table. There is an additional core question in network automation for spine-leaf, which is whether the granularity of automation should be at the box level or at the POD/set of boxes level. Something Juniper has been focusing on (RIFT), and which might be relevant in the SP market, depending on the operational scale and expertise of the operator.

For the use cases where Arista can leverage its competitive differentiation, primarily peering and DCI today, but potentially spine-leaf architectures in other domains as they play out, they will be an interesting company to watch.

when it comes to addressing SP move to CLOS more important than RIFT (which is more of a nice to have if you want to get your CLOS up easily and yes, RIFT does a much better flood reduction _and_ balancing than anything else on the table if you dig into it) is flood reflection which allows you to scale out your network when the IGP maxes out _without_ the problem of creating a single point of failure in the "abstracted CLOS" which will lead over time to all the "let's not use chassis" problems like NSR again. And flood reflection allows also TE within the abstracted CLOS without a massive refactoring of e.g. RSVP-TE. May not be the more popular thing these days to talk about RSVP-TE but the amount of deployment of that and business riding on it is massive.