Network Design: Operations Needs by Customer Segment

The Important

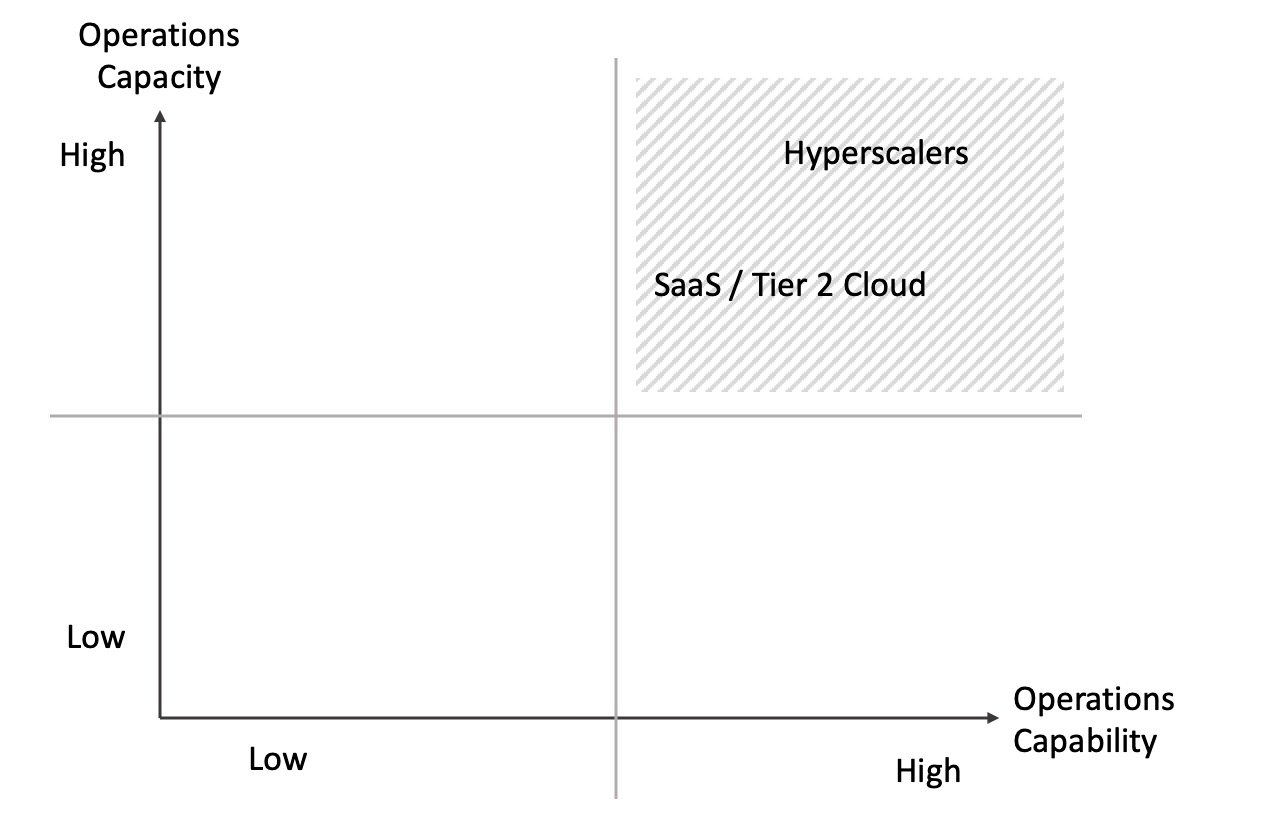

Operation needs by customer segment is influenced by operations capacity and capability, as well as the outcome needed for a business / mission.

Variation has implications for solution design / delivery across different customer segments; including consequences for optionality and tradeoffs.

Related / Building on

Discussion

In this article, two of the dimensions of optionality and tradeoffs introduced in “NETWORK ARCHITECTURE: A THREE OLIVE MARTINI” are discussed. Those two dimensions are operations capacity and operations capability. How these dimensions impact what technology suppliers need to deliver, and what these segments themselves need to do, is the focus.

Hyperscalers & SaaS have disrupted IT on two key axis. Operations excellence and of emerging importance in network design/architecture. Operations and the network itself, are more symbiotic than they have been in the past.

The common narrative is that hyperscalers are different because they are essentially software development companies, and that is their core competency. That single thought goes a long way to understanding the dynamic. However, that is not a framing which allows a holistic perspective on a) why they are disruptive and b) where other businesses stand in comparison to them.

How did hyperscalers disrupt with operations excellence? By having more capacity and capabilities than ever before, matched with equipment architectures to fit.

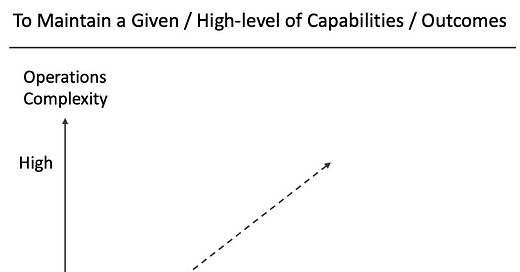

Through much experience, there is general consensus, you cannot reduce complexity, for a given outcome, you can only move it around. As hyperscalers moved towards simpler, repeatable units of compute, storage, and network, there was an inevitable consequence, for which, they were uniquely equipped to respond. Increased operational complexity, requiring increased operational capability & capacity (to maintain a high-level of sophisticated outcomes.

Figure 1. Operations Complexity vs Network/Equipment Simplicity

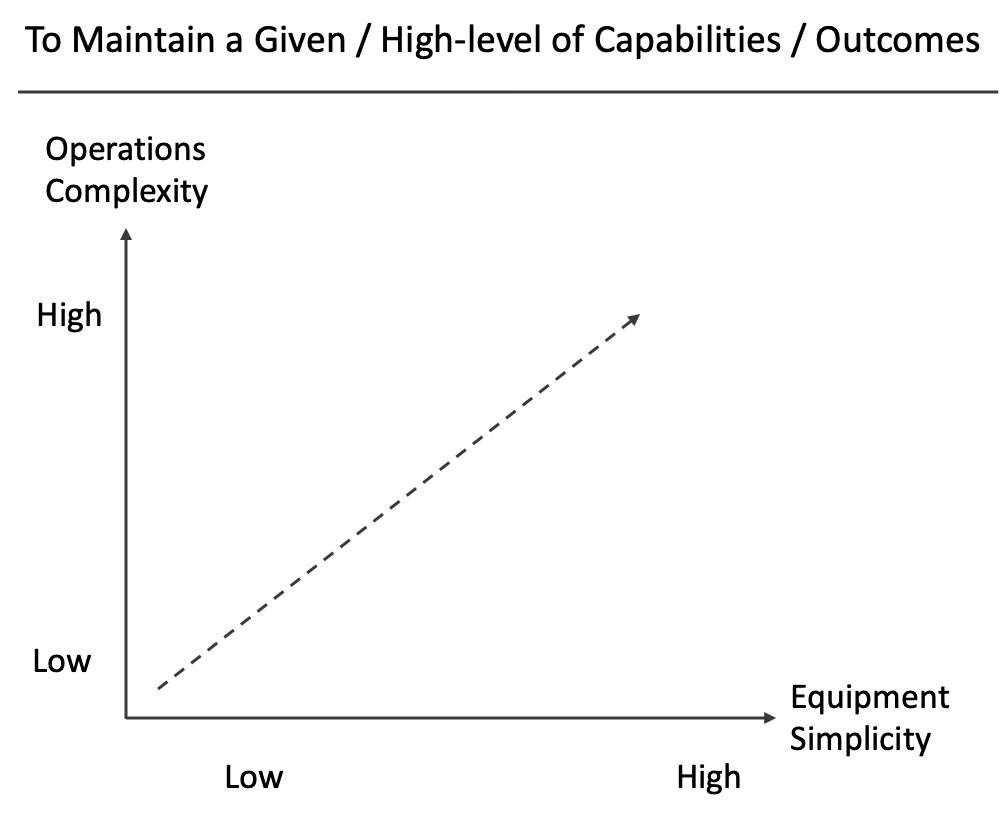

With scale, a born-in-the-cloud operations mindset, new operations cultures, and new levels of automation, hyperscalers had both operations capacity and capability.

Figure 2. Operations Capacity vs Capability by customer segment

This leaves all entities with a simple question: can I match this operations capacity and capability? It also leaves technology suppliers with a question: what does each customer segment need most? These are interesting questions, because different customer segments undoubtedly have different operations capacities and capabilities.

Figure 3. Relative Operations Capacity vs Capability by customer segment (based on intuition & experience, not research - feedback welcome)

Capability Defined

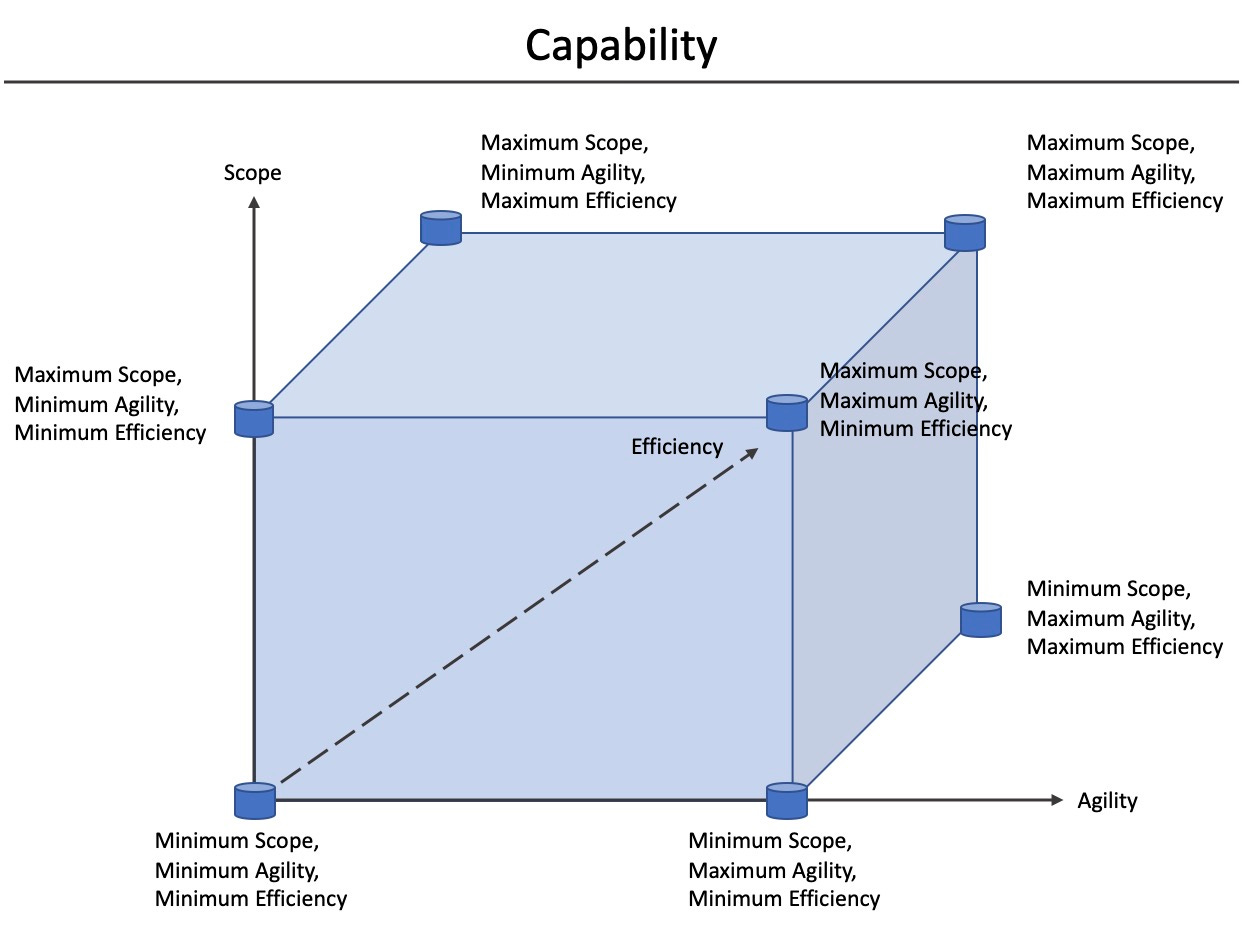

Definition: Number of distinct outcomes, per IT unit, per second, per unit of currency.

In other words, the number of different operations that can be performed, per unit of storage, compute, and/or network, at a given cost. More simply, productivity. Maximum quality & availability assumed and/or deducted from the time / cost to complete an operation.

Figure 4. Capability

Not all segments necessarily need or want the same capabilities. To the extent a capability is provided, it must be provided quickly, efficiently, without error, in either the equipment’s software, on-prem operational software, or cloud-based software/services.

Some capabilities are best centralized, and some are best distributed / de-centralized. Across many aspects of compute, whether it be SD-WAN routing or Artificial Intelligence / ML, the industry is recognizing this point.

Capacity Defined

Capability is the number of operations per unit, whereas capacity is the number of units.

Manual approaches based on human intervention can sometimes deliver significant capabilities, but this approach is not always scalable to large numbers of units. Approaches that are, represent the leading edge of capacity, notably automation and autonomy.

Being able to scale to large numbers of units, while maintaining significant capability (as viewed across both the equipment and operations environment), with little to no increase in time or cost per operation, are the hallmarks of capacity. Being able to complete X operations in 2 years, is clearly a different / lower capacity than being able to complete X operations in 2 seconds.

SME

That small and medium sized enterprises / businesses (SME) have the smallest IT capacity, and the least ability to invest in new capabilities, is well known. Not surprisingly, SME was the first of the established customer segments, not including born-in-the-cloud startups, to adopt many cloud services and cloud managed services. SMEs do not have the capacity or capability to reproduce what a cloud-based service offers.

SMEs need equipment that integrates (needed) capability in a way that is as zero-touch as possible. Both cloud-based managed services and/or AI-driven equipment approaches are seeking to meet these needs.

Mid-Market, Large Enterprise & Global 2000

What is true for SME, is true for other Enterprise segments, varying by degree. The larger the Enterprise, the more mission-critical IT/Networks, the higher likelihood of IT capacity and capabilities. The largest 200 Enterprises in North America are a common target for technology suppliers who win through best-of-breed value propositions, and long, intimate sales cycles, with technical decision markers. “Global 2000” is used in this article as a global approximation of this dynamic, but the number maybe significantly smaller.

The long-tail of Enterprises and the largest/mission-critical enterprises are different not only in their technology needs, but also in the go-to-market (GTM) motion. While channels may play a fulfillment role in enterprises of all sizes, they play an important solution role for Enterprises that do not have significant internal capacity / capabilities. Generally speaking, the more important the channel is in a customer segment, the simpler and more zero-touch an offering/solution should be. This can be a very different and foreign motion for technology suppliers who started life focused on hyperscalers, SP, or large enterprise.

From SME to Global 2000/North American 200, there is a range of IT capacities and capabilities in different customer segments, and therefore a range of offering/solution and GTM optimizations required by technology suppliers.

Service Providers

Service Providers (SPs) have invested significantly in IT for decades, and it has often been a source of competitive advantage, for example billing systems. The move to flat-rate services diminished some of the billing system advantage and the cloud inflections around DevOps/SRE/NetOps were disruptive. So much so that the last few years have seen a number of partnerships between SPs and Cloud titans. For this not to had been the case, SPs would have required organic transformation (often fails in many industries) or inorganic transformation (good targets may not be clear and regulation/public sector policy may also be a barrier).

Partnership may be the best way for SPs to move forward, which raises a question for technology suppliers: do they build solutions for SPs or Cloud titans? To which the answer is probably “Yes”, putting pressure on solution evolution from technology suppliers. Technology suppliers may also require different approaches depending on whether the use case is traditional/fundamental network infrastructure, or something emerging, like edge cloud / mult-access computing (MEC).

So the net, SPs have capacity, but they have a capability gap that is hard to close, hence the willingness to partner with technology suppliers are cloud builders.

SaaS / Tier 2 Cloud

SaaS has been at the forefront of IT transformation, dramatically changing customer experience, and adopting cloud-native approaches to IT. There are differences in both capacity and capability between hyperscalers and SaaS / Tier 2 Cloud, with Hyperscalers taking a much more public leadership role in areas like new languages (GO), new computing models (serverless), and utility business models (infrastructure as a service). SaaS has been a powerful force in the adoption of subscription models.

SaaS / Tier 2 Cloud are likely well-positioned with respect to IT Capacity and Capabilities, needing a little more targeted solutions support from technology suppliers than hyperscalers need.

Startups

Many startups are now “born in the cloud”. How their capacity and capabilities evolves is a function of execution and business success. Capabilities are likely to be good in many cases (leaning heavily on hyperscalers). Capacity will depend on the scale of the startup, of course, smaller than hyperscalers.

Conclusion

Common operations capacity and capability varies by customer segment, as does the needs of each customer segment. As a result, the gap that each customer segment needs to close, varies, as well as the the capabilities that need to be built in to each technology supplier’s offering / solution. This variation has impact for optionality and tradeoffs in network design / architecture.